Special Report Smart Ship Development Status and Tasks(1)

페이지 정보

작성자 최고관리자 댓글 0건 조회 3,484회 작성일 19-07-12 17:17본문

I. Smart Ship Summary

1. Smart Ship Definition and Concept

The US-based American Bureau of Shipping(ABS) defines Smart Ship as ‘vessels with significant levels of automation and data communication for monitoring and operating systems.’ Vessels already have certain levels of automation and communication functions. However, Smart Ships are equipped with even more sophisticated systems.

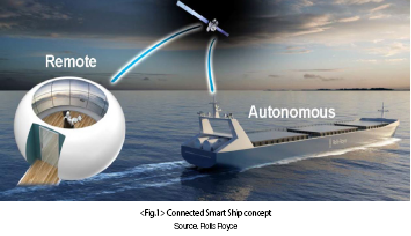

Smart Ships are being developed to increase convenience whilst saving costs by enabling monitoring and control through satellite data communication from land, which is why they are called ‘connected smart ship’. The ultimate goal of Smart Ship development is to automate all manned operations. In order to do so, data from each ship-mounted device needs to be transmitted and monitored in real time. As a result, data communication through satellites is important to process and communicate large quantities of data.

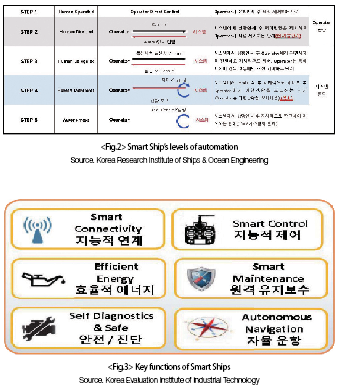

A Smart Ship can be classified into five degrees of automation. Current development goals are at the fourth degree - self-determination and control and ultimately endeavour for the fifth degree - complete automation. The first degree sees that all navigation and control is directed by the crew. In recent years, following advances in engineering and technology, the second degree of automation – systemized-determination – is being utilized. Parts of the third degree – automated control technology – are also being utilized. The fourth degree of Smart Ship automation - systemized self-determination - is targeted in the short run, and in the best case scenario can potentially include automated control with only manned supervision. Once enough actual sailing time, as well as trial and error data, have been accumulated, manned supervision would no longer be required and full automation would be possible. However, this goal would require long term efforts.

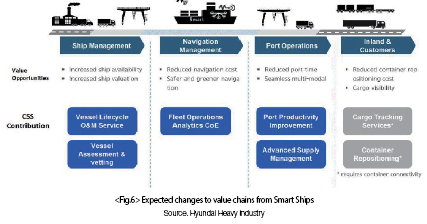

Smart Ship development is inclusive of everything from navigation equipment to safety, communications, energy efficiency, maintenance as well as legislative research. The key functions of a Smart Ship include monitoring the ship’s systems and intelligent decision-making, communication, intelligent control, energy efficiency from navigational efficiency, safety diagnosis and intelligent action, and remote maintenance. In order to realize such functionality, it is necessary to develop hardware for all parts of the ship which is capable of sensing and communication, suitable for high-efficiency autonomous navigation.

In addition to hardware, much effort is required to develop intelligent software(monitoring, diagnosis, analysis, control etc), communication, and other forms of software. Efforts should not end at technological development, but considering unmanned vessels, incorporate domestic efforts to reform maritime laws as well as continued discussions at an international level.

The foundations for Smart Ship development is digital technology and related application technologies. Furthermore, addressing issues such as insufficient crew and strengthened marine environment-protection laws have also become key contributing factors to the Smart Ship movement. Hardware and software development has become the cornerstone of Smart Ship development through equipment digitization, application of sensors and communication functions, and artificial intelligence. These technologies have already been applied in the aviation sector and have achieved stable autonomous navigation. Autonomous vehicles have also reached commercialization. Rapid development in other modes of transportation has expedited the development of Smart Ships.

Factors such as calls for fuel efficiency from strengthened marine environmental regulations as well as reducing safety hazards arising from man-made errors are also driving the shipping and shipbuilding industries to seek Smart Ship development.

Smart Ships are expected to reduce shipping, safety, and maintenance crew and staff numbers. Automation is also expected to reduce fuel and voyage costs from intelligent control as well as safety hazards arising from man-made errors. Furthermore, increased efficiency from reduced maintenance hours and increased efficiency from ports and harbour automation are expected.

In addition, Smart Ships are expected to create new value chains and jobs in connection to new relations established between ports/ harbours and logistics automation. The co-relationship between unmanned ships and smart technology is expected to lead to automated loading and unloading of cargo. This will inevitably lead to efficient onshore logistics, shortening logistical flow time and efficient exchange of import and export cargo.

When on-land monitoring of vessels through telecommunications becomes possible, new operations and maintenance(O&M) services can be expected. Current systems require vessels to sail to maintenance docks; however, it is expected that through remote monitoring, service providers will be able to provide active global management system services. Through such developments, a variety of new occupations such as data monitoring analysts and service schedule managers are expected to emerge. In line with these changes, Hyundai Heavy Industries has strengthened its capabilities by gaining autonomy as a subsidiary. It seems that global shipbuilders and marine-related businesses are preparing to enter the market.

Technological changes from Smart Ship developments may potentially affect shipbuilding market leadership. Current market leaders in the new shipbuilding market, Korean shipyards may risk their leadership positioning to large industrial companies with technologies and systems if they fail to develop Smart Ships in time. Therefore, it is critical, especially now, that efforts are made to adapt to change and sincere attempts are made to become market leaders. It is difficult to predict the operationality of the Smart Ship market, but it is expected to change within the next 15 – 20 years.

At present, functioning remote monitoring technologies have begun to be installed in ships and is likely to evolve towards unmanned operational technologies. Through its own roadmap, Rolls Royce plans to complete its unmanned vessels by 2035. They aim to reduce crew numbers and implement remote control by 2020. It seems that slow market developments have hindered their plans.

II. Smart Ship Development Status by Country/Region

1. Europe

(1) MUNIN Project

① Maritime Unmanned Navigation through Intelligence in Networks (MUNIN) Project outline

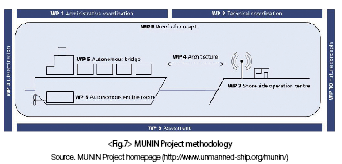

The MUNIN Project is an EU-led R&D project aimed at examining the feasibility and test-bed structure of unmanned autonomous navigation vessel technology as well as its economic and legal structures. The Project was held for three years beginning September 2012, with a total budget of 3.8 million Euros of which 2.9 million Euros was invested by the EU. Two research institutes, three universities, and three sensor companies including ship sensor manufacturers were involved.

② MUNIN Project meaning

Preceding development of a full-fledged Smart Ship, feasibility and potential to reduce future errors as well as the direction of development was reviewed and suggested. Cost benefits and legal review were undertaken to reduce the developer’s uncertainty about economic efficiency and institutional risk to encourage development. In doing so, reliable results supporting the feasibility of a large-scale, unmanned autonomous navigation ship development project was produced.

(2) Yara-Kongsberg Project

Yara, a Norwegian fertilizer company and Kongsberg, a global marine electronics manufacturer, have agreed to construct and test a small, smart electric propulsion container ship. They are currently in the process of conducting test-runs.

The Yara Birkeland is an eco-friendly small and smart container ship capable of coastal operations. Data from trial operations are expected to provide necessary information for large-scale Smart Ship development.

However, the schedule has been delayed a year and a half. Although the Project has been delayed, it is attracting global attention as Kongsberg, the Smart Ship Industry leader will be able to obtain test-trial data to expedite development.

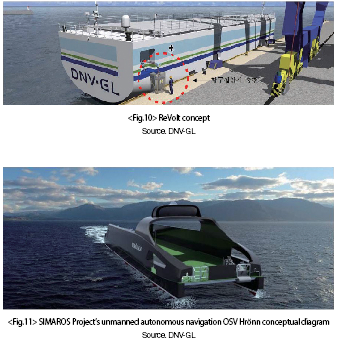

(3) ReVolt Project(DNV-GL)

DNV-GL developed ReVolt, a near-field electric propulsion cargo ship. ReVolts advantages are low operating costs and low maintenance costs. However, it is still in its conceptual stage with testing done only on a miniature scale.

Based on the concept that the ReVolt Project is a small offshore vessel, its impact on the global Smart Ship market will be insignificant. But, it is expected to contribute greatly to the development of unmanned autonomous vessel technology.

(4) SIMAROS Project

SIMAROS(Safe Implementation of Autonomous and Remote Operation of Ships) in an OSV unmanned ship development project. The Project includes not only development but also risk assessment and regulation development. However, the Project is currently delayed.

(5) ROMAS Project

The ROMAS(Remote Operation of Machinery & Automation Systems) Project is developing a system to control the ship from the ground by transferring the ship’s engine room to a land-based remote control centre. The Project’s main goal is to establish a regulatory framework with an emphasis on system verification, efficiency and safety rather than technological developments.

(6) AAWA

The Advanced Autonomous Waterborne Applications (AAWA) Project began in 2015 to carry out basic design and related research on remotely controlled vessels. Although vessel installation verification has been carried out after 2017, the results are yet to be published.

(7) AUTO SEA

The AUTO SEA Project aims to develop collision avoidance technology for autonomous vessels. Technology development consists of the four following areas:

- Sensor Fusion: Aside from existing marine radar, it is known that they are testing a combination of sensors that are not used in ships such as cameras, infrared rays, and LIDAR.

- Collision Avoidance: developing and testing various methods such as active methodology and reaction methodology.

- System Architecture: Review automobile and aviation strategies to establish and ensure reliable avoidance measures.

- Experimentation and verification

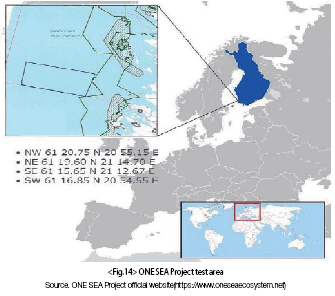

(8) ONE SEA

ONE SEA is a Finnish project aiming to establish and operate in an autonomous maritime ecosystem in the Baltic Sea by 2025. The Project seeks to plan and promote not only technological research but also in various areas such as ethical issues and regulations. The Project will build a test area and open it to all companies, research institutions and vessels from around the world.

(9) Kongsberg Maritime

Kongsberg is a technology-based Norwegian enterprise group and Kongsberg Maritime is the group’s core company. In developing Smart Ships, Kongsberg has developed its own platform to show the most advanced development ability as well as speed. In recent years, following the acquisition of Rolls Royce Commercial Marine, an industry leader, Kongsberg has established itself as one of the leading Smart Ship market players. With the expansion of its equipment business, Kongsberg as asserted that it will become the dominant player in the Smart Ship market and market leader in the new shipbuilding market. There is still some time for Smart Ships to become a reality and many more challenges that need to be overcome. The market’s future composition cannot be defined; however, the actions of Kongsberg need to be followed carefully.

(10) Implications for Smart Ship development in Europe

Europe is one of the most active regions for the Smart Ship development. It is making great efforts to rapidly take control of the market. When examining Europe’s development status, there is broad cooperation between countries and institutions within the European Union. Through cooperation and financial support, many European projects are currently producing test vessels to secure data and proceed towards technological development. Another feature of Europe’s Smart Ship development is that research and funding are applied to all necessary areas of development such as law, safety regulation, business modelling as well as technological development.

2. China

China is expected to receive intensive support including R&D support upon including the shipbuilding industry as a target support industry in ‘Made in China 2025’ announced in 2015. Thanks to government support, CSSC, the largest state-owned shipbuilding group, is developing ‘Green Dolphin’ a Smart Ship project beginning 2015. The actual vessel has already been built and test-operated.

In 2017, an unmanned cargo ship development alliance was formed with Chinese shipyards, shipping companies as well as foreign institutions and companies. China is also in the process of constructing the world’s largest autonomous vessel testing area.

Smart Ship development in China is expected to increase rapidly with the support of the state. As a result, China is likely to become a strong competitor in the future Smart Ship market.

3. Japan

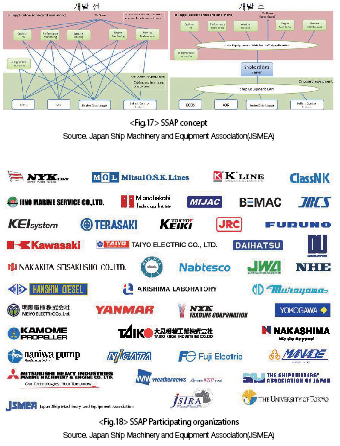

One of Japan’s leading Smart Ship development projects is the SSAP(Smart Ship Application Platform).

The Japanese government is recognizing Smart Ship development as a new opportunity for revival in the shipbuilding industry, and is planning and implementing comprehensive innovation to automate the sea freight industry. Real goals of the maritime productivity revolution(i-shipping) are to revitalize the industry by improving automation at every stage of the ship’s design, production, and operation. Japan appears to be making rapid progress through R&D cooperation between institutions in the private sector and long-term government support. It is very apparent that the Japanese government recognizes that Smart Ships are an opportunity to revive the shipbuilding industry.