Feature Story Trend of Market for Marine Equipment in Finland

페이지 정보

작성자 최고관리자 댓글 0건 조회 3,426회 작성일 19-05-24 21:12본문

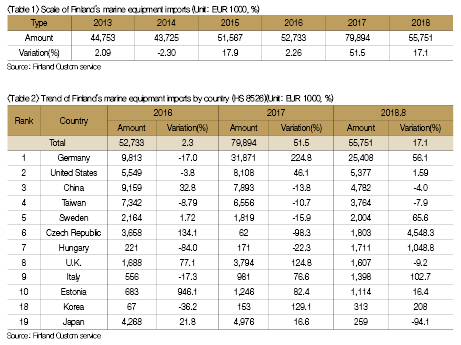

1. Market Size & Trend

The data published by the Finland Custom service show that the marine equipment import market has expanded steadily since 2015. Imports increased from EUR 43,725,000 in 2014 to EUR 79,894,000 in 2017, which represents an 82.7% increase. The imports stood at EUR 55,751,000 in August 2018, rising 17.1% year-on-year.

2. Trend of Import in Top 10 Countries over the Last 3 Years

According to the Statistics Finland, the market has been dominated by Germany while the United States and China have increased their imports significantly. Imports from Germany stood at EUR 2,548,000 which accounts for 45.6% of all import, as of August 2018. Imports from the United States and China stood at EUR 5,377,000 and EUR 4,782,000, respectively.

The two biggest importers are followed by Taiwan, Sweden, Czech Republic. There has been a significant variation in imports by country each year.

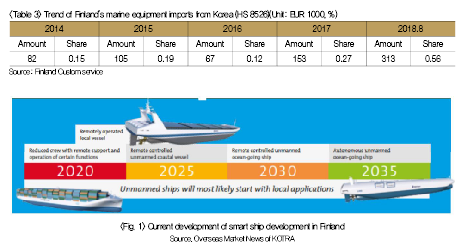

3. Scale and Trend of Imports from Korea

The market share for Korean marine equipment has increased since 2014, reaching 0.56% in August 2018. The import amount and market share have increased steadily, except for 2016. Import amount jumped from EUR 82,000 in 2014 to EUR 153,000 in 2017. In addition, import amount soared by 208% year-on-year to EUR 313,000, as of August 2018.

4. Recent Market Status

There have recently been active movements to reduce carbon emissions from ships worldwide.

The International Maritime Organization under the United Nations has been working on a ship energy efficiency project since 2016 and the EU is striving to mitigate carbon emissions by providing funds worth EUR 10 million for concerned project. Finland is stepping up the efforts for development of smart ship technology, led by industry leaders including Rolls-Royce Marine (R&D Center) and Wärtsilä, etc.

(1) Rolls-Royce Marine R&D Center

Rolls-Royce Marine opened its autonomous vessel research center in Turku, Finland in January 2018 and set a plan for operation of fully automated vessels in 2035 after pilot project of autonomous ship in 2020. Konberg of Norway announced its plan to acquire Rolls-Royce Marine in July 2018.

(2) Wärtsilä (capturing 50% share of global ship engine market)

Wärtsilä succeeded in remote operation of sip in the North Sea of Scotland in August of 2017(location of control center: San Diego, USA). Wärtsilä is currently developing the smart ship technology through the Digital Acceleration Center with an aim to commercialize the technology by 2025. It announced the ‘SEA20’ that aims to connect 20 port cities worldwide and automate ship operation by 2020.

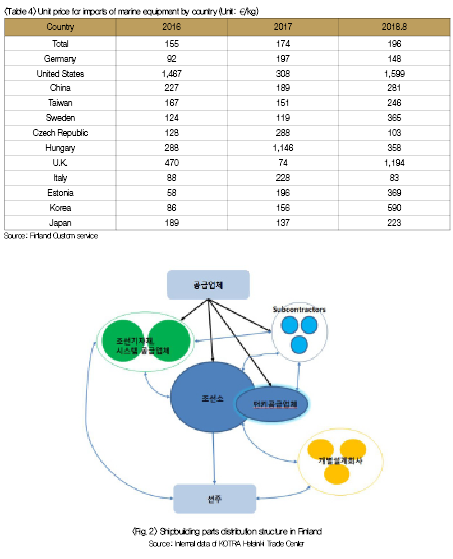

5. Trend of Competition & Major Competitive Products

Marine equipment import prices have risen since 2016. Germany, Czech Republic and Italy are supplying mainly low-end products, while the United States and U.K. are supplying high-end products. Import prices for Korean products have also risen steadily from EUR 86 in 2016 to EUR 590 in August, 2018.

6. Distribution Structure

Customer group will be divided into shipyards, device and system suppliers, turnkey suppliers and subcontractors, depending on product features. It would be the most effective for related companies to make entry into the shipbuilding market of Finland through turnkey suppliers, considering that shipyards are procuring from various subcontractors, such as equipment and system suppliers, designers, and turnkey suppliers, while turnkey suppliers are responsible for hull outfitting, HVAC systems, cabin installation, etc. Meanwhile, users of equipment and systems are mostly global companies. Selecting a supplier requires rigorous procedures and takes a long period of time. Moreover, individual designers and small and medium-sized subcontractors are competing or cooperating with SMEs(Small Medium Enterprises) of Korea.

7. Interview with Local Buyers - Marine Engine Manufacturer

‘Company A’, a leader in a global marine engine market, indicated that it would continue its efforts to slash carbon emissions from ship operations. Mr. B in charge of new business remarked that the marine market would also change in line with global trend of eco-friendliness.

He said that all of the parts related to ship operation such as engine, ship navigation system, port system, etc., would need to be combined with technologies and that he had never heard of any company that possessed new technology such as ship automation although Korean shipbuilding industry was focusing on construction of freight carriers insofar as he knew.

There is always an opportunity for companies with excellent technology as investment is expected to be made intensively in related technologies for the next 10 to 20 years.

8. Implications

Smart ship for carbon emission reduction still remains incipient. It is time that SMEs and start-ups should start to dominate the market. It would be essential for them to make entry into concerned market based on cooperation with world’s leading companies. Products that meet requirements of global corporations would need to be developed. If new technologies can be proposed in line with the milestones of global companies and projects such as those led by the U.N., domestic SMEs will have greater opportunities for successfully advancing into global market.