Feature Story Trend of Marine Equipment Market in India

페이지 정보

작성자 최고관리자 댓글 0건 조회 3,575회 작성일 19-05-29 12:25본문

1. Overview

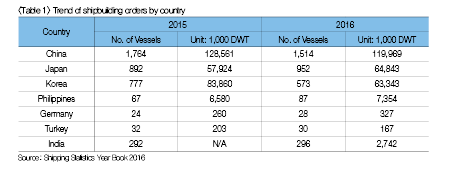

The shipbuilding industry continues to grow in Asia and the Pacific regions, including India, even amid the stagnation in global shipbuilding industry. The market share of shipbuilding sector across the Asia-Pacific region has increased by 11% on average over the last 5 years(2012 to 2016). India is one of the top 10 shipbuilding powerhouses in terms of shipbuilding orders, but has captured less than 1% share of global market.

The number of vessels owned by India is no more than 1.2% of the vessels worldwide, out of which the vessels built directly by India comprise less than 10%. In 2016, total number of vessels in India reached 1301 with a gross tonnage of 1.143 million tons.

2. Market size and trend

The Indian shipbuilding industry grew an average annual rate of 15% to USD 1.54 billion, as of 2017, and is expected to grow to USD 3 billion by 2020.

There were only 12 shipyards throughout India during the time of the nation’s independence in 1947, and most of them were located at Kolkata and Mumbai. Now, there are 32 shipyards, out of which 27 shipyards are operated by 27 shipbuilding companies.

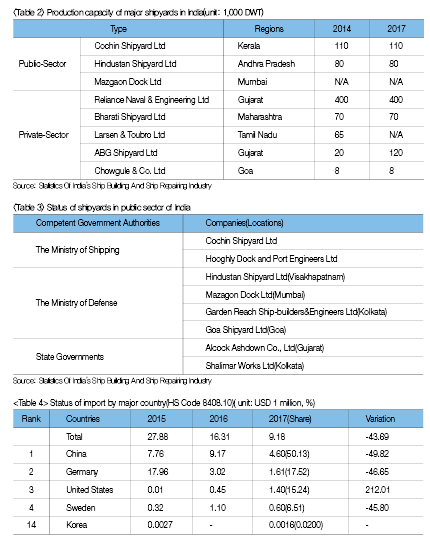

Shipbuilding companies can be classified largely into public-sector companies and private-sector companies, depending on the entities that manage them. Currently, there are 8 public-sector shipbuilding companies managed by the Ministry of Shipping and the Ministry of Defense under the central government and state governments of India and 19 private-sector shipbuilding companies.

Based on production capacity, India has the 8 leading companies which consist of 3 public-sector companies and 5 private-sector companies.

The Ministry of Shipping is the government agency responsible for matters pertaining to ship-related licenses and laws/regulation. For current status of shipyards under jurisdiction of each government agency, see the Table 3.

3. Trend of import market

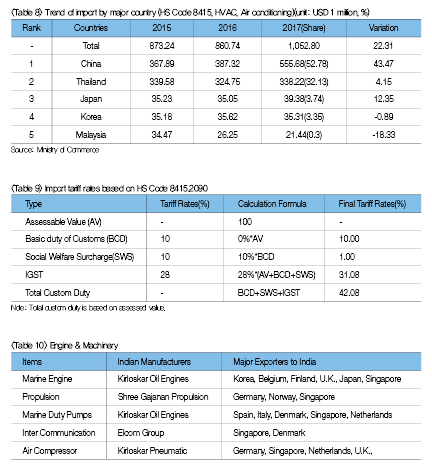

Marine equipment imported by India include the engines(gas turbines, diesel engines, propulsion systems and other parts), electrical equipment(communication equipment, navigation), outfit facilities(air conditioners, refrigerators and valves), steel for ship, etc. For major items imported by India, see the Table 4.

Import tariff rates based on HS Code 8408.1093(Compre ssion-ignition internal combustion piston engines) are presented in Table 5 below.

Import tariff rates based on HS Code 8415.2090(Air conditioning machines, comprising a motor-driven fan and elements for changing the temperature and humidity) are presented in Table 9 below.

4. Trend of competition and major competitors

New orders for dredgers, small bulk carriers, passenger ships, etc., are expected to increase in the wake of inland waterway development from the perspective of demand related to shipbuilding in India. The demand for LNG carriers and cargo carriers is also expected to rise 1.8 times by 2025 on the back of the increase in the demand for petroleum and petrochemical products.

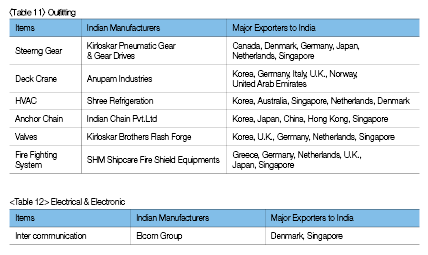

Most of India’s inland waterways remain underdeveloped despite the geographical advantage of 14,000km-long rivers and canals. However, demand for shipping has been created on the basis of the 12 major ports and 205 small and medium-sized port infrastructures located along 7,515km-long waterfront. Major parts industry related to shipbuilding include ① engine & machinery, ② outfitting, ③ electrical & electronic sectors. Major exporters to India and major manufacturers in India are presented in Table 10 through 12.

The Indian shipbuilding industry is characterized by strong demand for naval shipbuilding and ship repair. More than half of naval vessels are considered to be over 20 years old while over 80% of submarines are old. So, at least 200 vessels need to be built in the next decade. In addition, the coast guard is considered likely to need 150 new vessels by 2020.

5. Implications

Strategies to make entry into Indian shipbuilding and equipment markets include the parts exports and OEM supply through vender registration, etc. The engine sector provides an opportunity for Korean companies, given that India does not have the technology for integration of diesel engine, gas and steam turbine, which has been therefore commissioned to foreign contractors, and has a reliance on imported key parts related to engines.

Furthermore, India has a dependence on imported special steel for construction of submarines, shipboard navigation and telecommunication equipments, which increases the possibility of cooperation between Korea and India in the field of state-of-art communication technology.

In fact, Kunal Nangia of NN Shipbuilders and Engineers, a company located near Mumbai, India, said that he was working with Korean companies on shipbuilding technology and expressed his desire to further expand cooperation in the field of shipbuilding-related technology. Ravi Prakash of Goa Shipyard, praised the Korean marine equipment for excellent performance and stressed that there is a rising demand for parts related to ship engine and HVAC(Heating, Ventilating, and Air Conditioning) for vessels.

As approximately 41% of the vessels owned by India have exceeded 20 years of service life, it would be necessary to consider making entry into ship repair market. Rather than exporting to agents, it would be necessary to consider expanding transactions through joint venture with shipyards and vendor registration, etc., over the long-term. In relation to that, Daihatsu of Japan signed a licensing agreement with Kirleskar Oil Engines Ltd of India. Moreover, Walchandnagar industries Limited & DCNS of France sealed a partnership agreement with India to supply naval ship gearboxes to India.

Based on the opinions of local companies towards such demand, India-related companies have also been found interested in cooperation with Korea. In fact, Roby Varghese of Cochin Shipyard said that he wanted to work with Korean companies and expressed the hope that many Korean companies would apply for vendor registration when the online vendor registration system currently under development was launched. In addition, Deepak of Shreee Gajanan Propulsion, a manufacturer of marine propeller parts, expressed his desire to build partnership with excellent Korean companies so as to raise the production capacity of his company and expand the business.