Feature Story Can CO2 capture and nuclear get ships to net zero?

페이지 정보

작성자 최고관리자 댓글 0건 조회 1,038회 작성일 23-12-14 18:12본문

“In this decisive decade for shipping decarbonization, no stone should be left unturned in securing the future we need and want,” Eirik Ovrum, Maritime Principal Consultant at DNV and lead author of the Forecast says. “Our research indicates conditions under which carbon capture and nuclear could help bridge the gap between short-term measures and the bigger effort needed beyond 2030 to achieve 2040 and 2050 targets in the new IMO and forthcoming EU emissions regulations.”

Evaluating CO2 capture and nuclear to cut ship emissions

The studies add fresh insight to assist maritime stakeholders who have to make costly investment decisions now on ship design and operations, and on what fuels to produce, distribute and bunker.

The research has two goals. One is to establish if using these technologies is realistic operationally. The second is to compare their lifetime costs with fuel strategies most often discussed in the industry, such as fuel oil, liquefied natural gas(LNG), methanol and ammonia, each blending in carbon-neutral fuels (bio-/e-MGO, bio-/e-LNG, bio-/e-methanol, blue/e-ammonia) to comply with greenhouse gas(GHG) emission reduction targets.

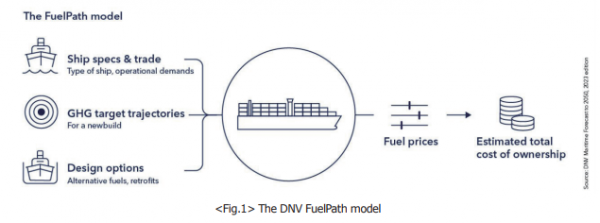

DNV’s FuelPath model provides results for various scenarios

DNV’s techno-economic evaluation involves two case studies using the company’s tried and tested FuelPath model for a large, modern deep-sea ship, a 15,000 TEU container vessel sailing between the Far East and Western Europe.

Inputs that can be varied(Figure 1) in the model include ship specifications and use, a newbuild’s greenhouse gas(GHG) emission targets and design options such as converters and fuel systems.

Studying ship decarbonization post-2030

Maritime Forecast to 2050 describes the technical, operational and economic assumptions involved in the case studies. In essence, the model assesses the economic performance of available design options related to a fuel over a vessel’s lifetime. The outputs include total cost of ownership and the cost of fuel strategies under different fuel-price scenarios. Annual costs include annual payments on capital expenditure(CAPEX), fuel costs, carbon prices and operating expenditure(OPEX).

Benchmarking fuel strategies for the case-study ship

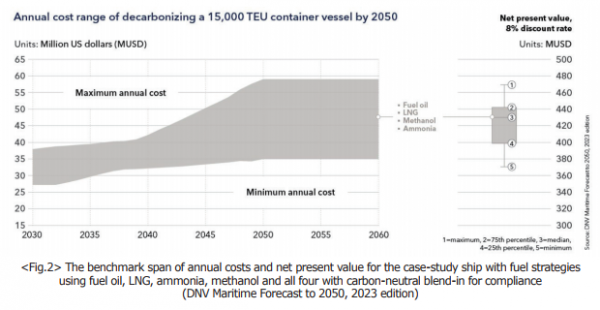

Based on real-world data and experience, the research first benchmarks the cost of the fuel strategies reflecting energy converter and fuel-system design options open to the case-study vessel over its lifetime.

More specifically, DNV draws on its data-driven estimates of maximum and minimum fuel prices annually over the period 2030–2060 to create benchmark spans of annual costs and net present value for the case-study ship for various fuel strategies(Figure 2). It uses these spans to evaluate under what conditions on-board carbon capture and nuclear propulsion could be feasible.

On-board CCS case study model

Assumptions for this study are described extensively in Maritime Forecast to 2050. Briefly though, the ship runs on heavy fuel oil(HFO), has a carbon dioxide(CO2) capture unit and storage tanks, and is fitted with a scrubber for sulphur oxides(SOX) and exhaust pre-treatment.

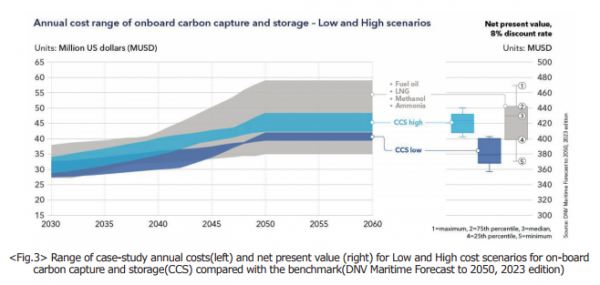

The study models annual costs under two on-board CO2 capture and storage(CCS) scenarios, Low and High cost, to compensate for economic uncertainties such as CAPEX and OPEX. It focuses on two parameters that it assesses as impacting most on the economics of on-board CO2 capture. One is the ‘fuel penalty’, the extra energy used for operating the capture unit. The other is the ‘CO2 deposit cost’, the sum of the CO2 transport and storage costs.

What is required for an economic case for on-board CCS?

For the annual cost range, the Low CSS(cost) scenario is seen to perform well against the other fuel strategies(Figure 3). The Forecast attributes this partly to the HFO price in the scenarios, and partly to fuel penalty and CO2 deposit costs compared with the cost of buying a larger share of carbon-neutral fuels.

The High CCS(cost) scenario performs around the middle of the studied fuel strategies. For net present value, the High CCS (cost) case is close to the mean for the fuel strategies by mid-century while the Low CCS(cost) case outperforms three-quarters of them.

“Our research suggests there can be an economic case for on-board CCS if the capture technologies have low fuel penalties and if a CCS industry can offer the low CO2 storage costs in our model,” Ovrum says.

Uncertainties over the future supply and cost of carbon-neutral fuels are compelling reasons for shipowners, ports and other stakeholders to consider all technology options for reaching net zero. DNV’s latest Maritime Forecast to 2050 includes case studies on whether on-board carbon capture and nuclear propulsion could be significant options.

Nuclear propulsion case study model

Assumptions for this are fully described in Maritime Forecast to 2050. One is that the reactor is leased along with its related systems and services. This is because CAPEX for nuclear propulsion is uncertain but thought likely to be up to twice the cost of the ship itself.

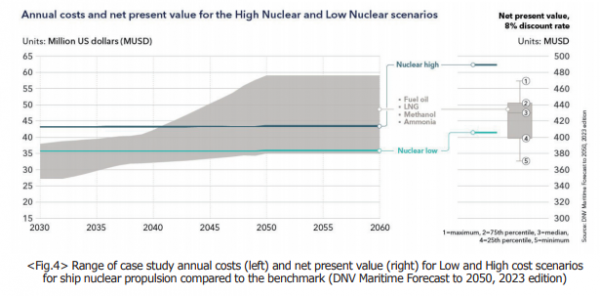

As with the carbon capture study, High Nuclear and Low Nuclear cost scenarios are used to mitigate uncertainty over reactor costs for merchant vessels (the Forecast discusses cost drivers).

What is required for an economic case for nuclear propulsion?

Figure 4 shows the estimated annual costs(CAPEX, OPEX, fuel cost, carbon cost) and net present values for nuclear propulsion compared with the benchmark fuel strategies (fuel oil, LNG, methanol and ammonia) during ship decarbonization.

The annual costs of nuclear appear as more or less stable compared with the benchmark cost range that increases from 2030 to decarbonization in 2050. This, the Forecast concludes, indicates that nuclear propulsion will be increasingly competitive as GHG limits are tightened.

“The takeaway is that there can be an economic case for nuclear propulsion if reactors are developed that can reach the lower range of cost levels described here,” Ovrum concludes.

Key takeaways from the case studies

DNV’s conclusions support the prospect that under the right conditions, on-board CO2 capture and nuclear propulsion could mitigate competition for sustainable biomass and renewable electricity.

On-board CO2 capture could release maritime from competing for carbon-neutral fuels.

Nuclear propulsion is itself carbon-neutral and less exposed to price swings and supply issues than carbon-neutral fuels.

The implications for maritime stakeholders

The report acknowledges that carbon capture would need on-board facilities to remove exhaust CO2, onshore processing of captured CO2, temporary storage and offloading facilities, and infrastructure such as pipelines and permanent storage. Obstacles to nuclear include international regulations, public perception and technology costs.

“Both technologies face barriers for sure. But our studies suggest they could in the right circumstances be economical and valuable additions to the flexible toolbox maritime needs to meet mid- and long-term decarbonization targets amid anticipated competition for carbon-neutral fuels,” Ovrum emphasizes.

■ Source: DNV www.dnv.com