Special Report Suggestions for Korea Offshore Wind Development Plan(English)

페이지 정보

작성자 최고관리자 댓글 0건 조회 2,232회 작성일 19-05-20 18:01본문

1. Introduction

Offshore wind power is an industry that is difficult to promote without large-scale business investments and significant supply chain technological and financial capabilities. Many European countries and China are promoting offshore wind power as a growth engine industry. This is due to a high industrial ripple effect and high job creation. In 2016, Korea and the United States became offshore wind power nations. Compared to other nations, our interest in offshore wind power is not too late, but our growth rates are considerably slower.

Global offshore wind power market trend analysis highlights major implications that are derived from national, technological, and player perspectives. By benchmarking the offshore wind power policies of European countries, applicable recommendations for Korea are suggested in a macro perspective in terms of the six development axes. European countries are progressing their offshore wind power policies towards expansion by reducing their development risks and uncertain industry investments. And are suggesting, from a macro perspective, a capacity enhancement of offshore wind power supply chain’s capability. Suggestions for innovation are presented for Levelized Cost of Energy (LCOE) competitiveness and securing future technologies through technological innovation.

Comprehensive proposals for the direction of offshore wind power development have been made by considering the Korea’s domestic reality of the six axes. In the future, it is hoped that this article will be helpful as the detailed development strategy is refined at the national level through consultation and discussion with stakeholders.

2. Global offshore wind power market trends

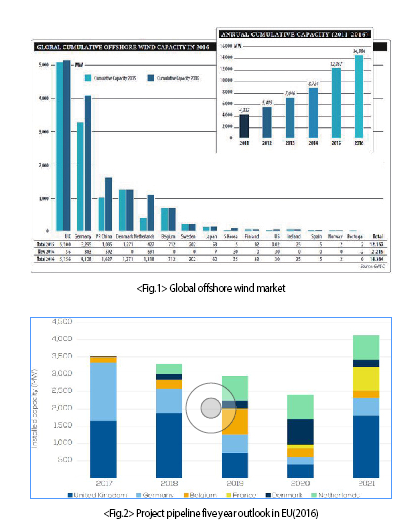

According to a GWEC statistics report, at the end of 2016, a cumulative wind capacity of 14.4GW was used in operation. Newly installed offshore wind power capacity in 2016 was 2.2GW. New installations of 30MW in Korea and the United States were included in the statistics. In 2017, the world’s first commercial offshore wind farm, the Vindeby Wind Farm in Denmark, which had been in operation for 25 years was decommissioned. This is significant, considering offshore wind power’s relatively short history, that more-and-more offshore wind farms are being decommissioned after completing their project lives.

When implications from offshore wind power market trends are categorized by country, technology, and players, the following can be summarized.

(1) Implications from country-by-country offshore wind power markets

Implication 1: 4 European countries account for 81% of global offshore wind power

The cumulative offshore wind power capacity of the United Kingdom, Germany, Denmark and the Netherlands was 11.6GW, accounting for 81% of global offshore wind power capacity. The dominance of these major European countries is expected to continue for some time until the offshore wind power capacity of Asia and the United States reaches the same track.

Implication 2: The United Kingdom is the world’s number one offshore wind power producer and expected to remain for the next five years.

The United Kingdom is expected to, over the next five years, construct 5GW worth of new offshore wind turbines and is expected to maintain its position as the world’s number one offshore wind power producer by building on its existing 5.1GW. Meanwhile, late starters, France and Belgium are forecast to surpass 1GW in the same period.

Implication 3: China enters global top three offshore wind power producer In 2015, China surpassed 1GW and in 2016 alone, installed 592MV surpassing Denmark to enter global top three offshore wind power producers. In recent years, China, based on its track record, has made efforts to advance into Europe, the world’s main offshore wind power producing region. This has big implications for Korea which began its offshore wind power operations around the same time.

Implication 4: Korea and the United States become offshore wind power nations

Korea has built ‘Tam Ra’ a 30MW offshore wind farm and the United States has constructed ‘Block Island’ a 30MW wind farm, thus becoming offshore wind power nations. In the near future, France and Taiwan are expected to enter the offshore wind power market.

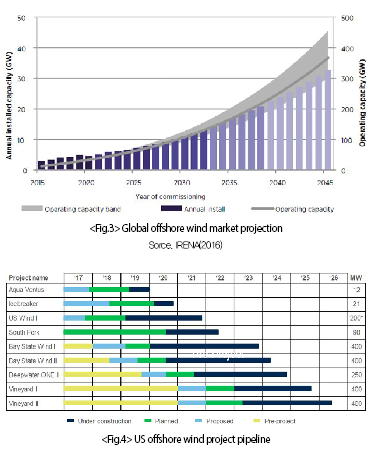

Implication 5: Offshore wind power expected to surpass 100GW by 2030

Global offshore wind power is expected to surpass 100GW by 2030. Currently, new offshore wind power installation is growing steadily at 5GW per annum. Beginning in 2030, new installation rate is expected to grow at 10GW per annum.

Implication 6: Offshore wind power late starter’s rapid progression

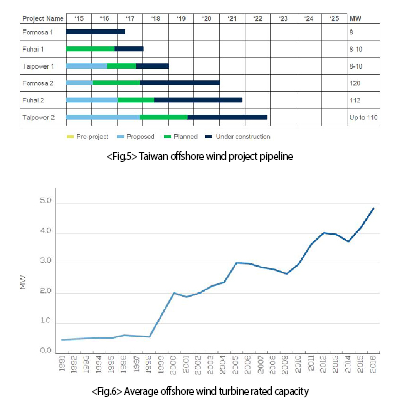

Offshore wind power late starter’s the United States and Taiwan’s rapid progression will be subject to future benchmarking. According to MAKE’s United States market analysis released during Trump’s presidency, 22GW worth of offshore wind farms developments is expected by 2026. As shown in figure 4, the majority of offshore wind farms in the United States will have capacities of 400MW.

In Asia, Taiwan is active in offshore wind power. European energy companies such as Dong Energy, Northland Power have set up branches in Taiwan and have begun developing farms. Overseas, there is more interest in Taiwan’s offshore wind power than Korea’s. In the Asian region, only Taiwan and India have placed emphasis on international cooperation in developing farms. In the medium to long run, the growth of the Korean market through overseas cooperation will require much discussion.

(2) Implications of offshore wind power technology

Implication 1: Europe’s offshore wind turbines average a capacity of 4.8MW

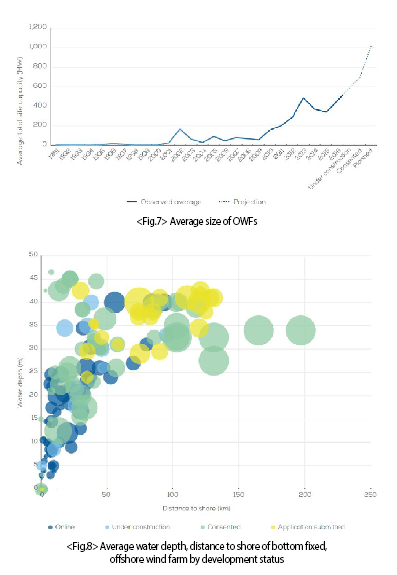

In order to reduce the LCOE, the trend is heading towards offshore wind turbines with greater capacity. From 2015, the average offshore wind turbine capacity grew 15% and the application of 8MW offshore wind turbines is expected to grow continuously into the future.

Implication 2: Europe’s average offshore wind farm capacity surpasses 379.5MW

In order to reduce LCOE, the trend is heading towards offshore wind farm with higher capacity. In 2016, newly installed offshore wind power farms averaged a capacity of 379.5MW, this is a 12% growth from 2015. When considering farms that are currently under construction or have received licenses, the average per farm capacity is expected to surpass 500MW. When considering the economies of scale and installation capabilities, the average capacity of farms in the planning or licencing stages is expected to surpass 1GW.

Implication 3: The average depth of European wind farms is 29.2m and average separation distance is 43.5km

Due to technical limitations of line installation depths, farms with fixed wind structures are expected to be kept within depths up to 45m. The average distance between wind farms and the land is 43.5km. The majority of farms currently under construction or those which have secured licences have a separation distance of over 100km; however, the majority of constructed farms only have a separation distance of 50km. Therefore, the average separation distance of offshore wind farms is expected to grow at a gradual pace.

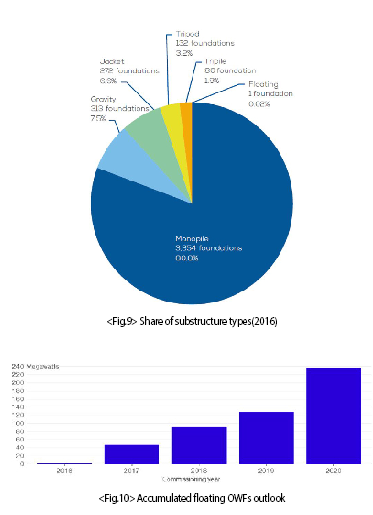

Implication 4: Monopile-style structures account for 80.8% of the infrastructure market

The depth of offshore installations are kept to depths below 45m; however, as the larger Monopile technology develops, Monopiles will remained the general trend in Europe. Although Jacket-styled structures saw slight growth, 88% of new offshore wind power structures were Monopile-styled. Due to Korea’s different geological conditions from Europe, but also considering Koreas manufacturing and installation capabilities, the application of Monopile’s will be limited from quite some time.

Implication 5: Commercialization of floating offshore wind power

Bloomberg forecasts a cumulated floating offshore wind power capacity of 237MW by 2020. This signals that floating offshore wind power has entered into a commercialization phase. Commercialization of floating offshore wind power is expected to accelerate after 2020.

(3) Player implications of the offshore wind power market

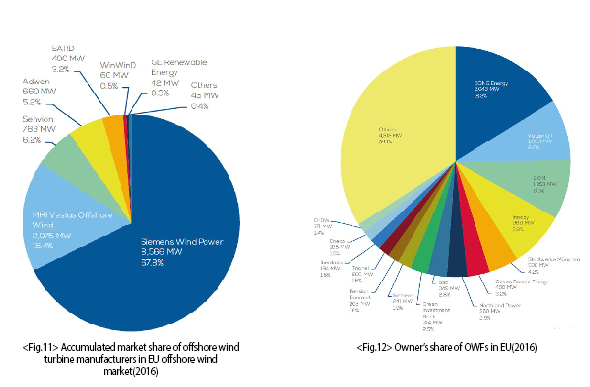

Implication 1: Siemens, MHI-VESTAS lead the offshore wind turbine market

Siemens, MHI-VESTAS account for 84.2% of Europe’s offshore wind power market, but Sevnion and Adwen are expected to gradually increase their market share. US-based GE owns domestic offshore wind power installation and is challenging the Chinese market after establishing a joint venture with a Chinese company in 2016. Based on installation results of China’s domestic offshore wind power market, it is expected that China’s wind turbine manufacturers will become strong competitors in the market.

Implication 2: Power companies lead wind farm development

Energy companies such as Dong Energy, Vattenfall, E.ON and Innogy, in relation to new investments in 2016, had a market share of 68%, leading the market. What was notable was the Siemens, the number one player in the offshore wind turbine market, entered into farm development. The proportion of investors in financial institutions is also increasing. In particular, it is worth noting the achievements of United Kingdom’s Green Investment Bank, which was established to invest in renewable energy.

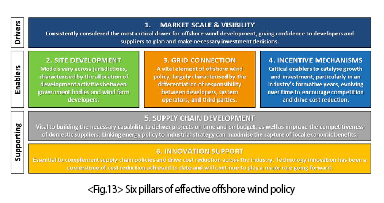

3. Offshore wind power cultivation policy

Offshore wind power entails large-scale investments, high industrial-relation effects, and job creation effects. Thus, are required to present and support a clear vision of the government. China’s Four Major Axis (2011) is an example of an offshore wind power development policy. Korea has room for reflection from a lack of comprehensive promotion policies. Figure 13 shows the six axes of the IEA’s proposed offshore wind power promotion policy. This article’s approach to the IEA’s offshore wind power promotion policy’s six axes takes into consideration Korea’s domestic conditions.

(1) Proposing a long-term vision for the government

The government of countries leading the offshore wind power market have proposed long-term visions for the industry. Almost all countries have clearly presented a long-term vision of constructing several GW worth of offshore wind farms by 2030. The United Kingdom and Germany have presented long-term visions to construct 10GW by 2020 and 15GW by 2030, respectively. It is important to note that long-term vision is highly likely to reflect ambitious goals, and there are many cases in which reality cannot meet goals, requiring re-adjustment. The long-term vision of the government ought to take the following into account.

- Offshore wind power policy goals to be included in long-term energy strategy

- Periodic performance measurement required

- Long-term energy strategy meets policy framework

- Short and mid-term roadmap to supplement long-term strategy uncertainty

- Participation of various stakeholders from the national energy strategy

(2) Short-term development

Developing multiple offshore wind farms at the same time is inefficient due to limitations of the supply chain. Given offshore wind power’s spatial planning, it is necessary to develop an offshore wind farm in a step-by-step manner. The United Kingdom’s is a prime example. Development is divided into levels 1, 2 and 3: time-wise, from shallow waters to deeper waters; distance-wise, from short distance to long distance; farm scale-wise, from a small farm to a big farm.

Realizing potential for offshore wind power in Korea is currently being carried out. In the short term, it will be difficult to incorporate the farm currently under development into the spatial planning, but, like the United Kingdom, it is important to create a step-by-step development plan as a benchmark and establish a spatial plan linked to mid-term development goals.

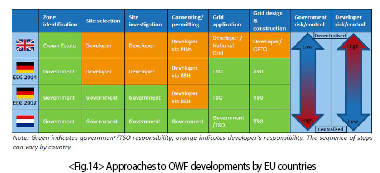

The European offshore wind power industry is gradually emphasizing the importance of the state’s involvement. Figure 14 shows the major European offshore wind power nations’ government involvement model. It is necessary to research the involvement of Korea’s national and local governments. Besides, the United Kingdom, wind farm development is heading towards state-centralized development. In particular, in some European countries, there have been cases of delay from the beginning stages of farm development’s grid linkage. In Korea, it is also necessary to link plans for the offshore wind power to Korea Electronic Power Corporation(KEPCO)’s grid. If the offshore wind farms planned in Jeju and the South-western Sea are not linked to the expansion of the grid, construction postponement and/or the curtailment of generated power is inevitable. From now on, besides current development’s, whether or not the state will support wind farm exploration and survey requires extensive discussion.

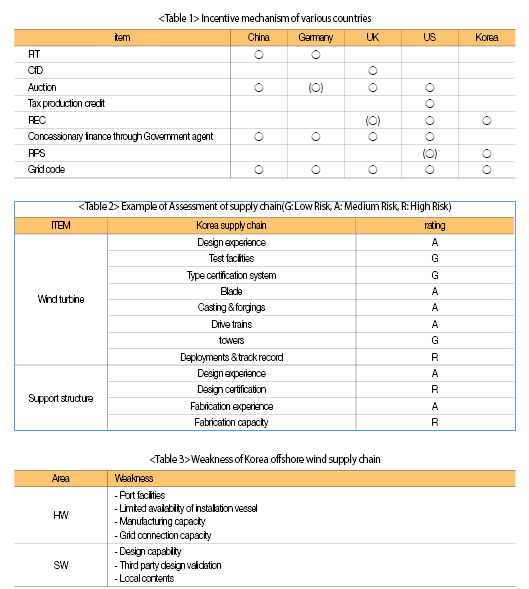

(3) New renewable energy support system

Many countries are operating support systems to expand new renewable energy. Table 1 is a comparison chart depicting new renewable energy support systems of major offshore wind power nations. The United Kingdom has terminated its recently developed new renewable energy obligations, the Renewable Obligation(RO), and has begun operating a Contract for Difference(CfD) on its wind farms. This system is advantageous in that it eliminates concerns from industry-related price fluctuations, which can lead to long-term investments. Furthermore, project budget disclosure and transparency can facilitate accelerated innovation, investments and economic growth of offshore wind powers’ supply chain. On a special note, offshore wind power’s 2020 LCOE goal of 120 Euro/MWh was achieved early in 2016, and recently ENBW and Dong Energy’s 900MW offshore wind farm’s were sold in an auction without a support system. The example of Europe’s major offshore wind power nations highlight that industry’s like offshore wind power, which requires large-scale investments and possess significant risk, needs a strong and early government-backed support system until the industry become competitive.

After Korea switched systems from Fee in Tariff(FIT) to Renewable Portfolio System(RPS) in 2012, contributions have been made to the expansion of new renewable energy; however, there has been a lack of contribution to the expansion of offshore wind power. It is the opinion of the industry that at current levels REC weighting for offshore wind power is too low to begin offshore wind power projects. There are a multitude of complex reasons for delaying the expansion of offshore wind power, but the greatest cause arises from a disagreement between the government and industry’s opinions on support systems. The majority of Europe’s major offshore wind power nations have adopted the FIT system, they receive strong initial support, greatly improving economic efficiency. In recent years, the fact that technology and cost competitiveness have been secured without the assistance of a support system has great implications.

(4) Offshore wind power supply chain network

The ability of the supply chain is important to achieve offshore wind power’s visions, but research on Korea’s domestic offshore wind power supply capability is weak. Table 2 is an essay on Korea’s offshore wind power supply chain’s capabilities. Due to the limitations of Korea’s offshore wind power market, it lacks a track record, and reliability has not been sufficiently verified. Manufacturing capacity is also very low compared to Europe, where the average farm size is 400MW. Manufacturing capacity can has been offset by a relatively large market disparity with Europe’s due to industry investments. If the market size were to expand, then the long-term outlook would be high. Table 3 shows the present common macro vulnerabilities in the supply chain of offshore wind power.

The design capability of the 5MW offshore wind turbines and the substructure is relatively high due to the government’ R&D support. However, as project certification systems are not in place in Korea, if a third-party design verification process is not settled, then project and financing risk, as well as increased insurance costs, will all rise.

The port is important infrastructure that must be expanded, in advance, at the construction and operation stages. In Europe and the United States, research on the port is conducted by the government. Accessibility is important for the development of offshore wind power, therefore it is necessary to review ports in the West Sea, Jeju Island and South Sea regions.

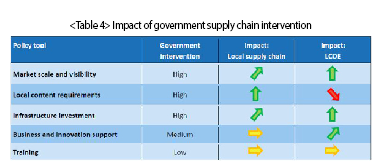

Overseas, local context must be incorporated into auction condition’s that farms must be managed as one to protect the domestic offshore wind power industry’s supply chain and regional economic stimulation. The United Kingdom requires a 50% local context plan be submitted to participate in CfD bids. France requires a 40% local context plan in Rounds 1 and 2. In the United States, under the Jones Act, vessels originating from one’s home country must be entered. Korea also needs to discuss local context. In the case, foreign equipment is installed in Korea, it is necessary to review the localization requirement of some parts and demand for job creation to protect the local economy. Overseas examples ought to be used as benchmarks. Table 4 is an analysis of the effect of the government’s involvement on the offshore wind farm supply chain. The government’s vision and effective involvement will have a significant influence on market growth, regional economic development and supply chain capabilities.

(5) Technology innovation

Due to the delayed expansion of the offshore wind power market, it may be too early to discuss technology innovation. After standardizing Europe’s offshore wind power technological innovation trends, key proposals for technology and R&D policies will be made.

Innovation point 1: Development of 8MW+ large offshore wind turbine

It is expected that offshore wind farms being constructed in Europe at around 2020 will install 8MW wind turbines. In addition, offshore wind farms are expected to achieve 1GW. In Korea, a 7MW offshore wind turbine was being developed; however, was not commercialized. The development of an 8MW offshore wind turbine is a large-scale technology development project that requires tens of millions of dollars in investments. Due to the limitations of Korea’s domestic offshore wind power market, the development of an 8MW wind power turbine will not be expected for some time.

Innovation point 2: Floating offshore wind power research

Floating offshore wind power has many advantages over fixed offshore wind power. Fixed substructures are limited in that they cannot be installed in waters deeper than 45m, but also constructions costs are significantly higher. Floating substructures have the advantage of a standardized design, which significantly reduces engineering and installation costs. Many Korean universities and research institutes have been researching floating offshore wind power. A pilot study of a 750kW wind turbine is underway. Numerous research on floating offshore wind power has been carried out by various universities and government-affiliated research institutes. Korea, which is surrounded by water on three sides, has sufficient space for floating offshore wind farms. Floating offshore wind power is special in that there are many opportunities for synergy with the shipbuilding industry. Depending on the design concept, the floating platform can be built on a dock and transported to the farm by a tugboat. Floating offshore wind power research must be accompanied by empirical research and also requires extensive R&D investment.

Innovation point 3: Relation to ESS

Energy Storage System(ESS) is a system that can store and deliver produced energy when needed. It is an efficient means to build a stable and efficient supply and demand system, and also solve irregular wind power generation. Currently, research is only focused on linking ESS with solar and onshore wind power. Globally, research on linking ESS and offshore wind power is still in its early stages. Statoil has announced a research plan linking ESS with a 30MW floating offshore wind farm, and in the United States, GE has begun research. In 2017, the United Kingdom incorporated links between offshore wind power and ESS in its government-wide strategy. Korea has relatively abundant ESS battery technology and application results. It is necessary to carry out research on linking ESS with offshore wind power.

Innovation point 4: Promoting offshore wind power’s development direction

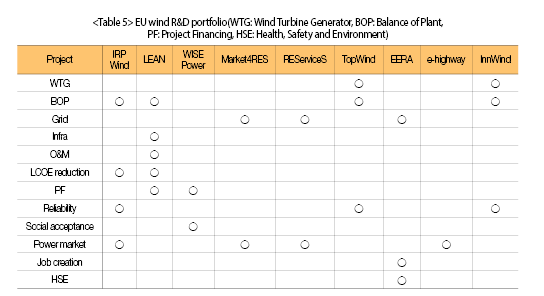

Korea’s national R&D is a system supporting product and empirical research. On the other hand, unlike Korea, Europe focuses on a wide variety of industry vitalization techniques such as industrial-supportive research, financial support, maritime safety, maintenance, and the electric power market design. Table 5 is an analysis of Europe’s important offshore wind power research project portfolios. It is necessary to discuss the reorganization of Korea’s R&D from a product development-based system to an industry supportive system.

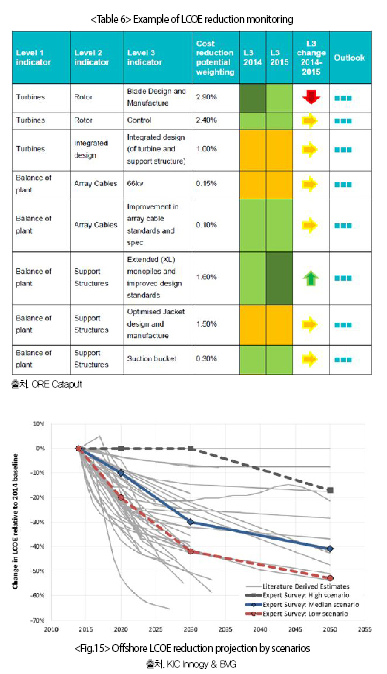

Innovation point 5: Cost monitoring

Reducing LCOE is an important goal of R&D. In order to reduce LCOE, research on long-term monitoring of construction and operating costs needs to be undertaken. The table is an example LCOE monitoring performance indicator by ORE Catapult, a UK research institute. A long-term vision of offshore wind power requires an ambitious and conservative scenario analysis. Figure 15 is an example analysis of scenario-specific LCOE forecasts. Unfortunately, research of this sort is yet to be carried out in Korea. Scenario-specific LCOE monitoring needs to be linked. Korea lacks a culture of sharing development cost information. In order to expand offshore wind power, a systematic approach is needed to create a culture of cost information sharing to achieve the mutual goal of reducing LCOEs.

Innovation point 6: Initiating research on maritime safety standards

Safety standards of offshore wind power has been complying with the standards of the oil & gas industry. Recently, safety standards have been established to be suitable for offshore wind power. Korea’s offshore wind power standards are near existent but still, require more work.

In Europe, safety standards are either established by the government or by the industry. In Korea, it is necessary to start discussing the enactment of safety standards. Europe’s nine offshore wind power companies established the G9 and shared their safety statistics. It is necessary to initiate similar studies in Korea.

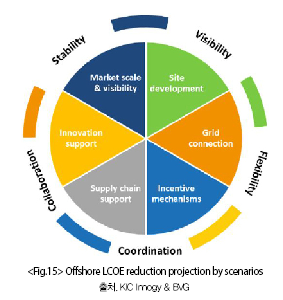

4. Suggestions

This paper has identified and explained the main points of recent offshore wind power trends, and has described from a technology and policy perspective, the core offshore wind power development measures in sections 2 and 3. Offshore wind power has many stakeholders, and effective involvement of the national and local governments is very important. The evolution of offshore wind power strategies needed to maintain the principles of stability, visibility, flexibility, coordination and cooperation are shown in Figure 16.

- Stability: Stability is important to maintain trust between the government and industry and to ensure the continuance of the sector. Retrospective changes to policies can significantly impair investor confidence, risking the increase in premiums. A clear and transparent legal foundation is essential, and policy changes should not undermine industry confidence.

- Visibility: Due to the long development periods, predictable visibility is needed to allow developers, the supply chain and the authorities to plan and make investment decisions. Long-term market size, support systems, licensing systems, and steady schedules should be highly visible.

- Flexibility: Regulatory flexibility maximizes opportunities for wind farm operators to reduce project costs. This may include the adoption of new technologies, flexibility of farm selection and layout, and flexible development schedules.

- Adjustment: Clear and coordinated responsibilities between government departments with mutual goals are important to ensure smooth and efficient delivery of offshore wind power programs. The One-Stop System can be an effective means of ensuring efficient and precise coordination as well as maximizing effectiveness for wind farm developers.

- Cooperation: Cooperation between the government and industry is important to provide economically viable offshore wind power. Intergovernmental cooperation can enhance interconnection, manage distribution schedules to avoid supply bottlenecks, and maximize consistency of regulatory approvals. On the other hand, cooperation between the government and industry on innovative activities can maximize the effectiveness of R&D investments and provide low-cost technology solutions.

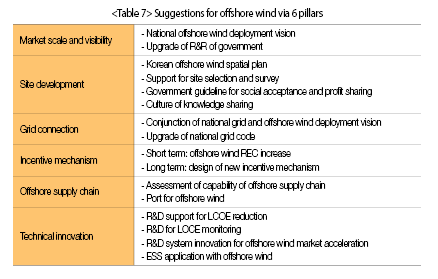

Table 7 is proposing macro-level development plans for the six offshore wind power developments, considering Korea’s domestic circumstances. It is time for the power of collective intelligence between the many related organizations to come together.

<Some analytical data are the results from research carried out with the support of the UK government’s Prosperity Fund.(PPF SKS 000045). Some market data was conducted with support from MAKE Consulting. A portion of the proposal is a reference from the presentation made at the Korea Offshore Wind Power Industry Forum held on June 8, 2017.>